contactless credit card encryption A fraudster with an NFC reader would access contactless cards in someone's pocket or bag in crowded public spaces like the subway. By doing so, they would extract enough sensitive data to make a counterfeit card or make online purchases. Review: Moo.com’s NFC Business Cards. Chris Gampat. No Comments. Last updated on 01/02/2017. 01/04/2017. 2 Mins read. Spread the love . The business card as a whole hasn’t really seen a lot of .

0 · how to use contactless credit cards

1 · contactless security cards

2 · contactless credit card visa

3 · contactless credit card security

4 · contactless credit card scam

5 · contactless credit card payments

6 · contactless credit card online purchases

7 · contactless credit card fraud

$8.99

Are you ready to bust three myths about contactless cards? So let's jump right in. Three myths about the dangers of contactless cards. See more

Unlike older generations of banking cards with magnetic stripes, EMV cards use a smart microprocessor chip technology which: 1. Secures the . See moreScaremongering stories almost always follow new technology, and contactless is no exception. Reassure yourself and your customers by getting . See more

Credit cards with contactless payment technology can help protect your .A fraudster with an NFC reader would access contactless cards in someone's pocket or bag in crowded public spaces like the subway. By doing so, they would extract enough sensitive data to make a counterfeit card or make online purchases.

Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal. Credit card encryption is a security measure intended to reduce the likelihood of credit card information being stolen and used in fraudulent transactions. Credit card encryption.Ensure all transactions are encrypted: The private key/certificate used by the card to sign the transaction is never transmitted during the transaction and cannot be accessed. The private key/certificate is protected and encrypted on the card itself . Chip-based cards emerged as a successor, offering enhanced security through data encryption. These cards required insertion into payment terminals (POS) and authentication with a PIN, marking a.

Each contactless device must have its own unique secret key that uses standard encryption technology to generate a unique card verification value, cryptogram or authentication code that exclusively identifies each transaction.

Getty Images. Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure?. Security. NFC payments are generally considered secure. They often incorporate encryption to protect sensitive information such as credit card numbers. Additionally, many smartphones require authentication (such as a fingerprint scan or a passcode) before the payment is processed, adding another layer of security. Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology.

Yes, contactless credit cards are secure because they use the same security standards for transactions as EMV chip credit cards. Whether you’re using a contactless credit card and tapping to pay or inserting your EMV chip card into a card reader, the sensitive information sent to the card reader is encrypted.

A fraudster with an NFC reader would access contactless cards in someone's pocket or bag in crowded public spaces like the subway. By doing so, they would extract enough sensitive data to make a counterfeit card or make online purchases. Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal. Credit card encryption is a security measure intended to reduce the likelihood of credit card information being stolen and used in fraudulent transactions. Credit card encryption.Ensure all transactions are encrypted: The private key/certificate used by the card to sign the transaction is never transmitted during the transaction and cannot be accessed. The private key/certificate is protected and encrypted on the card itself .

Chip-based cards emerged as a successor, offering enhanced security through data encryption. These cards required insertion into payment terminals (POS) and authentication with a PIN, marking a.Each contactless device must have its own unique secret key that uses standard encryption technology to generate a unique card verification value, cryptogram or authentication code that exclusively identifies each transaction. Getty Images. Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure?.

natwest non contactless card

Security. NFC payments are generally considered secure. They often incorporate encryption to protect sensitive information such as credit card numbers. Additionally, many smartphones require authentication (such as a fingerprint scan or a passcode) before the payment is processed, adding another layer of security. Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology.

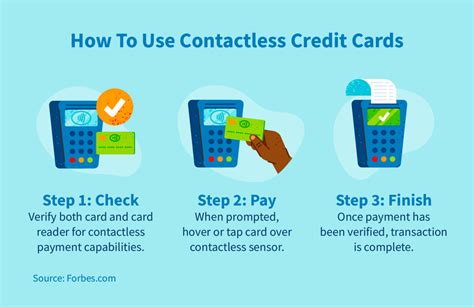

how to use contactless credit cards

As we know, an NFC card the size of a credit card can actually be replaced by a .

contactless credit card encryption|contactless credit card fraud