rfid scanning of card theft With the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how . By following the steps outlined in this guide, you have gained the knowledge and skills to create a custom NFC card that suits your needs and preferences. Throughout the process, you learned about the basics of NFC technology, the benefits of making your own card, and the different types of NFC cards you can create.

0 · what is rfid skimming

1 · what cards need rfid protection

2 · rfid scanning credit card theft

3 · rfid credit card scams

4 · rfid credit card identify

5 · protecting credit cards from rfid

6 · is rfid theft a problem

7 · is my credit card rfid

I would like to add the nfc to Google wallet but I don't know how to do that and even if it's possible.. You cant. The card issuer has to partner with Google, which is where the token used .

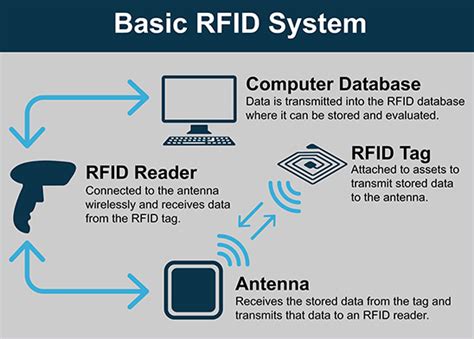

Radio-Frequency Identification (RFID) involves the use of radio waves to read and capture information stored on an electronic chip attached to an object. RFID chips, or “tags,” can be read via scanning devices from up to several feet away. These chips have been used by businesses for years to manage inventory . See moreSome security experts have voiced concerns about a phenomenon called RFID skimming, in which a thief with an RFID reader may be able to steal your credit card number or personal information simply by walking within a few feet of you. It’s a scary thought, . See more

While RFID skimming should be the least of your worries, it’s important to take steps to protect against the very real threats of credit card fraud and other forms of identity theft. Be proactive with automatic, 24/7 monitoring of your credit report and credit score, so you’ll . See moreWith the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how . Summary: Products such as “RFID wallets” claim to prevent frauds and scams like RFID skimming, in which thieves steal information off your chip-embedded credit card. Be wary of these claims; there are better forms of identity theft .With the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how to protect your RFID credit card from potential thefts and other common payment card frauds.

So, technically, all a thief needs is a scanner that can read the radio signals emitted by the RFID chip in your card. If they have one of these scanners, theoretically they would be able to steal credit card data if they’re within close proximity, and you wouldn’t even know it.

To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card. Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming" the.

RFID cards and tags can be rendered useless by hackers who generate a stronger signal than the RFID reader. This not only disrupts inventory tracking but also causes chaos by blocking access with ID cards.

RFID skimming is a method to unlawfully obtain someone's payment card information using a RFID reading device. How RFID skimming is performed. Modern payment cards have a built in chip that transmits card information wirelessly.

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. RFID stands for Radio Frequency Identification. RFID theft occurs when someone uses their own RFID reader to trigger the chip in your credit card; a process called ‘skimming’ or ‘digital pickpocketing.’. The card thinks it is being asked for information to carry out a sale.

In recent years, credit card companies have begun using RFID tags in selected cards to allow fast, contactless payments. Immediately, people began to worry about their credit card information being stolen. So someone invented “RFID-blocking” wallets. Summary: Products such as “RFID wallets” claim to prevent frauds and scams like RFID skimming, in which thieves steal information off your chip-embedded credit card. Be wary of these claims; there are better forms of identity theft .

With the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how to protect your RFID credit card from potential thefts and other common payment card frauds. So, technically, all a thief needs is a scanner that can read the radio signals emitted by the RFID chip in your card. If they have one of these scanners, theoretically they would be able to steal credit card data if they’re within close proximity, and you wouldn’t even know it.

To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card. Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming" the. RFID cards and tags can be rendered useless by hackers who generate a stronger signal than the RFID reader. This not only disrupts inventory tracking but also causes chaos by blocking access with ID cards.

RFID skimming is a method to unlawfully obtain someone's payment card information using a RFID reading device. How RFID skimming is performed. Modern payment cards have a built in chip that transmits card information wirelessly.

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. RFID stands for Radio Frequency Identification. RFID theft occurs when someone uses their own RFID reader to trigger the chip in your credit card; a process called ‘skimming’ or ‘digital pickpocketing.’. The card thinks it is being asked for information to carry out a sale.

what is rfid skimming

what cards need rfid protection

With Cards - Mobile Wallet, you can add everything to your cards wallet, including loyalty, payment, access, identity, and transport cards. In addition, the mobile pay app supports different types of cards, including .Mobile payment app utilizing NFC. MyCard - Contactless Payment is a premium finance application by Road Dogs Software. It is a mobile payment platform that makes it easy .

rfid scanning of card theft|what is rfid skimming