money not safe in bank skimming rfid chip Some security experts have voiced concerns about a phenomenon called RFID skimming, in which a thief with an RFID reader may be able to steal your credit card number or personal information simply by walking within a few feet of you. It’s a scary thought, . See more Accept Apple Pay, Android Pay, Samsung Pay, EMV chip, and magnetic swipe card payments with a single device. Use Clover Online to launch your business website, fully hosted and synced with your Clover Go reader.

0 · what is rfid skimming

1 · rfid wallet scam

2 · rfid skimming scam

3 · rfid scam

4 · idx rfid skimming

5 · fbi skimming credit card

6 · credit card skimming risks

7 · credit card skimming devices

Features: External NFC reader management and interaction. Parallell use of external and/or internal NFC (i.e. in the same activity, both enabled at the same time) Support for both tags and Android devices (Host Card Emulation), .

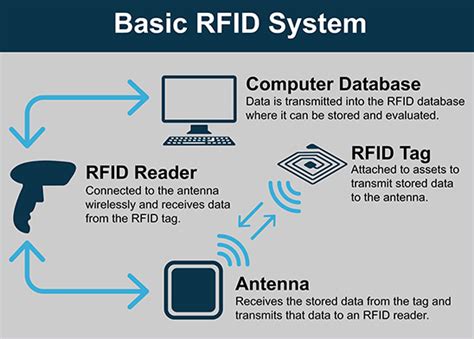

Radio-Frequency Identification (RFID) involves the use of radio waves to read and capture information stored on an electronic chip attached to an object. RFID chips, or “tags,” can be read via scanning devices from up to several feet away. These chips have been used by businesses for years to manage inventory . See more

Some security experts have voiced concerns about a phenomenon called RFID skimming, in which a thief with an RFID reader may be able to steal your credit card number or personal information simply by walking within a few feet of you. It’s a scary thought, . See moreWhile RFID skimming should be the least of your worries, it’s important to take steps to protect against the very real threats of credit card fraud and other forms of identity theft. Be proactive with automatic, 24/7 monitoring of your credit report and credit score, so you’ll . See more

Skimming occurs when devices illegally installed on or inside ATMs, point-of-sale (POS) .

You probably know that the embedded computer chips found in most credit and debit cards are meant to protect you from financial fraud. But you may have also heard of a scam called RFID skimming, where a thief steals the card number from your chip-embedded card just by walking past you.Skimming occurs when devices illegally installed on or inside ATMs, point-of-sale (POS) terminals, or fuel pumps capture card data and record cardholders’ PIN entries. Criminals use the data to. Card skimming theft can affect anyone who uses their credit or debit cards at ATMs, gas stations, restaurants or retail stores. A skimmer is a device installed on card readers that collec ts. 3 Ways Avoid Online Credit Card Skimming. Not surprisingly, there's a digital equivalent called e-skimming. The 2018 British Airways hack apparently relied heavily on such tactics.

A credit card skimmer is a device that’s sometimes installed illegally on ATMs, fuel pumps or point of sale (POS) systems. When customers swipe their credit or debit cards using the card reader, the skimmer can scan or skim their card information. Scam: Card-skimming thieves can make fraudulent purchases with information read from RFID-enabled credit cards carried in pockets and purses. MIXTURE. Examples: [Collected via e-mail, December.

Debit card fraud is up 70 percent, partly due to the use of skimmers and shimmers in ATMs and merchant card readers. Consumer Reports explains how to protect your debit and credit cards.

what is rfid skimming

rfid wallet scam

rfid tags what are they

Do not use an ATM or a credit or debit card reader if anything looks suspicious, such as loose or extra parts. Alert the machine owner or the police immediately. Avoid ATMs in remote places, especially if the area is not well lit or not visible to security cameras and the general public. Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming". Not only will you catch any possible card skimming, but regularly monitoring your financial accounts will help you stay vigilant about any possible fraud. A comprehensive guide to detecting illegal credit card skimmers, with advice on .

You probably know that the embedded computer chips found in most credit and debit cards are meant to protect you from financial fraud. But you may have also heard of a scam called RFID skimming, where a thief steals the card number from your chip-embedded card just by walking past you.Skimming occurs when devices illegally installed on or inside ATMs, point-of-sale (POS) terminals, or fuel pumps capture card data and record cardholders’ PIN entries. Criminals use the data to. Card skimming theft can affect anyone who uses their credit or debit cards at ATMs, gas stations, restaurants or retail stores. A skimmer is a device installed on card readers that collec ts.

3 Ways Avoid Online Credit Card Skimming. Not surprisingly, there's a digital equivalent called e-skimming. The 2018 British Airways hack apparently relied heavily on such tactics. A credit card skimmer is a device that’s sometimes installed illegally on ATMs, fuel pumps or point of sale (POS) systems. When customers swipe their credit or debit cards using the card reader, the skimmer can scan or skim their card information.

Scam: Card-skimming thieves can make fraudulent purchases with information read from RFID-enabled credit cards carried in pockets and purses. MIXTURE. Examples: [Collected via e-mail, December.

Debit card fraud is up 70 percent, partly due to the use of skimmers and shimmers in ATMs and merchant card readers. Consumer Reports explains how to protect your debit and credit cards.Do not use an ATM or a credit or debit card reader if anything looks suspicious, such as loose or extra parts. Alert the machine owner or the police immediately. Avoid ATMs in remote places, especially if the area is not well lit or not visible to security cameras and the general public. Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming".

samsung s21 rfid reader

rfid skimming scam

The Emerson Go reader app allows user to scan Emerson Go BT/NFC loggers. .

money not safe in bank skimming rfid chip|credit card skimming devices