santander contactless card age MyAccount (11-17): Comes with a contactless debit card but pays no interest. MySavings (7-17): Can only be managed online, but pays the top interest rate of 5%. Santander 123 Mini* NFC can be enabled and disabled seperately by performing the following: Swipe in from the right edge of the screen to open the charms bar. Tap " Search ". Type " NFC " into .

0 · santander pay by phone

1 · santander contactless limit

2 · santander contactless card renewal

3 · santander contactless card

4 · santander change pin

5 · santander change payment limit

6 · debit card tap limit

7 · contactless payment limit

The Nintendo Switch is less than a week old, and players are still learning its particulars. Today, we demonstrate where the amiibo NFC reader is located on the Nintendo Switch’s Joy-Cons and Pro Controller. With this knowledge you .

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.Use our app to activate your Santander Debit Mastercard® and more. Make the most of your debit card with the Santander ® Mobile Banking App 2. Download our Mobile Banking App to activate your debit card, create or change your PIN, put your misplaced card on hold, and set up alerts.

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.For children under age 13, the account must be opened in trust and managed by an adult (trustee). The trustee must be aged 18 or over, have parental responsibility for the child and have a Santander personal current account. Trustees must apply in branch. MyAccount (11-17): Comes with a contactless debit card but pays no interest. MySavings (7-17): Can only be managed online, but pays the top interest rate of 5%. Santander 123 Mini*

Make contactless, secure, and easy payments with your digital wallet. Add your Santander debit or credit card to Apple Pay, Google Pay, or Samsung Pay today.What is Google Pay™? Google Pay provides owners of Android® devices the ability to use their Android phones to make in store, in-app and online. payments using a Santander® credit or debit card. 2. How do I add my Santander cards to Google Pay? 3. What is the secure element of Google Pay? 4. Does it cost anything to use Google Pay?To open this account you must be under the age of 18 and live in the UK. For those under the age of 13 the account must be opened by an eligible trustee on behalf of a child (beneficiary).

As prepaid kids’ debit cards can be taken out for children from the age of six, these are the only options for children this young. They need to be at least 11 to get a child’s current account. Santander’s 123 Mini current account can be taken out for children younger than this but they can only get a cash or debit card once they’re 13. Read time 8 minutes. Want to help your child learn money management skills or save for a rainy day? Whether it’s pocket money or serious savings, there are lots of UK bank accounts out there for kids. A bank account can be a great way .Updated. Aug 19, 2024. Fact checked. There are two types of spending accounts for children: prepaid cards and children’s current accounts. With a child’s current account, you can set up a standing order instead of withdrawing from an ATM to give your kids their pocket money and you can show them how banking works in real life.

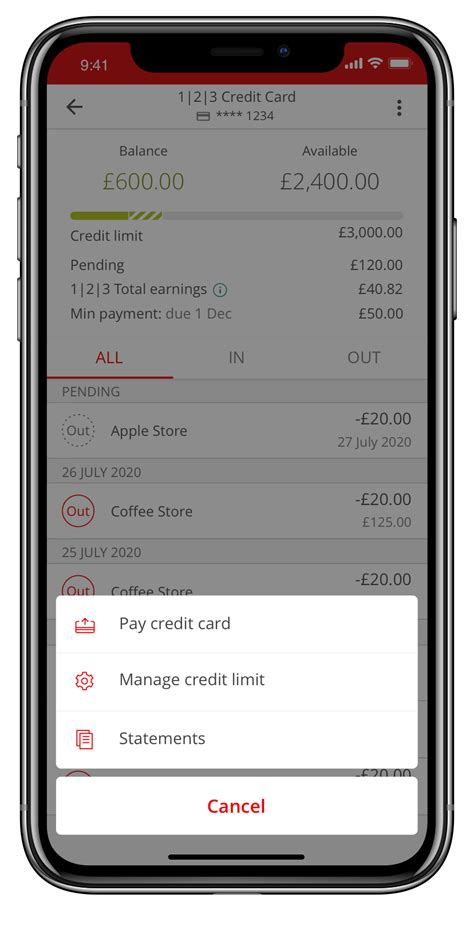

Use our app to activate your Santander Debit Mastercard® and more. Make the most of your debit card with the Santander ® Mobile Banking App 2. Download our Mobile Banking App to activate your debit card, create or change your PIN, put your misplaced card on hold, and set up alerts.

santander pay by phone

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.For children under age 13, the account must be opened in trust and managed by an adult (trustee). The trustee must be aged 18 or over, have parental responsibility for the child and have a Santander personal current account. Trustees must apply in branch. MyAccount (11-17): Comes with a contactless debit card but pays no interest. MySavings (7-17): Can only be managed online, but pays the top interest rate of 5%. Santander 123 Mini*Make contactless, secure, and easy payments with your digital wallet. Add your Santander debit or credit card to Apple Pay, Google Pay, or Samsung Pay today.

What is Google Pay™? Google Pay provides owners of Android® devices the ability to use their Android phones to make in store, in-app and online. payments using a Santander® credit or debit card. 2. How do I add my Santander cards to Google Pay? 3. What is the secure element of Google Pay? 4. Does it cost anything to use Google Pay?To open this account you must be under the age of 18 and live in the UK. For those under the age of 13 the account must be opened by an eligible trustee on behalf of a child (beneficiary).

As prepaid kids’ debit cards can be taken out for children from the age of six, these are the only options for children this young. They need to be at least 11 to get a child’s current account. Santander’s 123 Mini current account can be taken out for children younger than this but they can only get a cash or debit card once they’re 13.

Read time 8 minutes. Want to help your child learn money management skills or save for a rainy day? Whether it’s pocket money or serious savings, there are lots of UK bank accounts out there for kids. A bank account can be a great way .

santander contactless limit

Most (older) examples are using the Intent based approach: you are setting filters and use the tag dispatch system to be informed when an NFC tag is tapped to the NFC reader in your Android device.

santander contactless card age|santander contactless limit