contactless card statistics What do these contactless payment statistics mean for your small business? Our small business experts offer this advice: 1. Get equipped for biometrics:Customer comfort with biometric security measures will make contactless . See more $3.10

0 · The Contactless Payments Market Overview in USA for 2024

1 · Contactless cards are the future in the U.S.

2 · 27 Contactless Payments Statistics for 2024

$15.99

It is undeniable that the pandemic changed shopping habits. One of the most impacted areas across the world was contactless payments, which saw massive adoption starting in 2020. But was this impact lasting? Did contactless payments have staying power beyond quarantine and pandemic fears? As you . See moreBroadly, contactless payments can be divided into three categories: mobile or digital wallets (i.e., credit or debit cards from your bank or other non-financial institutions that are stored on your mobile device), QR codes, or tap-to-pay cards. In this section, we will . See moreWhat do these contactless payment statistics mean for your small business? Our small business experts offer this advice: 1. Get equipped for biometrics:Customer comfort with biometric security measures will make contactless . See moreWith an eye on the current contactless payments landscape, the next thing we will look at is how consumers are feeling about contactless payments, including their adoption habits and preferences. See more

Click through the questions below to get answers to some of your most frequently asked contactless payment questions. See more In a study released in April 2020, Mastercard reported that 79% of respondents . According to a forecast by Juniper Research, total contactless payment transactions are expected to grow to more than trillion by 2027, with a whopping 221% increase in contactless payments projected between 2022 and 2026. In a study released in April 2020, Mastercard reported that 79% of respondents across the globe said they were using some form of contactless payments.

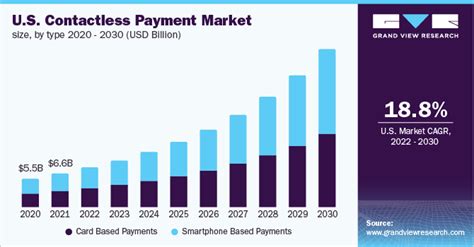

Here’s a snapshot of some of the key market statistics for contactless payments: Contactless payments market share in 2023: 25% of all card transactions; Number of contactless transactions in 2023: 17.9 billion; Contactless-enabled cards in circulation in 2023: 300 million; Merchant adoption of contactless payments by 2023: 85% of merchantsIn the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030..02 trillion in 2018 to The ongoing coronavirus pandemic has bolstered the number of Americans using contactless payments to 51%, according to a new Mastercard poll..05 trillion in 2019, before increasing to In New York, more than 70 percent of Visa cards are contactless enabled today, driven by the New York MTAs rollout of contactless to all subways and buses, which was completed in December 2020. Several large retailers are above or approaching 25 percent contactless transactions penetration..11 trillion in 2020.

The Contactless Payments Market Overview in USA for 2024

U.S. card issuers were slow in sending out contactless cards with embedded chips to their customers (Schulze 2019). Many retailers lagged in accepting chip-based payments because it was costly and complex (Weisbaum 2015). Among retailers that adopted chip technology, many did not enable RFID functionality. The graph shows the contactless payment market revenue in the United States from 2014 to 2025. In 2016, the contactless payment market in the United States generated some 29 billion U.S..They found that 46% of respondents had put contactless payment cards at the top of their wallets. Over half of consumers under 35 made this change to their purchasing habits. In addition, Mastercard discovered that the majority (82%) of participants consider contactless payment to be a safer way to pay. According to a forecast by Juniper Research, total contactless payment transactions are expected to grow to more than trillion by 2027, with a whopping 221% increase in contactless payments projected between 2022 and 2026.

In a study released in April 2020, Mastercard reported that 79% of respondents across the globe said they were using some form of contactless payments. Here’s a snapshot of some of the key market statistics for contactless payments: Contactless payments market share in 2023: 25% of all card transactions; Number of contactless transactions in 2023: 17.9 billion; Contactless-enabled cards in circulation in 2023: 300 million; Merchant adoption of contactless payments by 2023: 85% of merchants

In the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030..02 trillion in 2018 to The ongoing coronavirus pandemic has bolstered the number of Americans using contactless payments to 51%, according to a new Mastercard poll..05 trillion in 2019, before increasing to In New York, more than 70 percent of Visa cards are contactless enabled today, driven by the New York MTAs rollout of contactless to all subways and buses, which was completed in December 2020. Several large retailers are above or approaching 25 percent contactless transactions penetration..11 trillion in 2020. U.S. card issuers were slow in sending out contactless cards with embedded chips to their customers (Schulze 2019). Many retailers lagged in accepting chip-based payments because it was costly and complex (Weisbaum 2015). Among retailers that adopted chip technology, many did not enable RFID functionality. The graph shows the contactless payment market revenue in the United States from 2014 to 2025. In 2016, the contactless payment market in the United States generated some 29 billion U.S..

Contactless cards are the future in the U.S.

27 Contactless Payments Statistics for 2024

Buy Popl Digital Business Card - Smart NFC Networking Card - Tap to Share - iPhone & Android (Black): Accessories - Amazon.com FREE DELIVERY possible on eligible purchases

contactless card statistics|27 Contactless Payments Statistics for 2024