do credit cards have rfid or nfc Many RFID and NFC cards are marked with their respective technology identifiers. For example, NFC cards may have the “NFC” label or related symbols, while RFID cards might be marked with “RFID.”. If you see these labels, you can typically determine the card’s technology type.

Step 1. Go to Settings > Connections > NFC and contactless payments. Step 2. Tap Contactless payments, and then select your preferred payment app. * Image shown is for illustration purposes only. Step 3. Additional payment apps can .Hold down the power button on your phone. Select the option to power off or restart your device. Wait for your phone to completely shut down. After a few seconds, press the power button again to turn your phone back on. .

0 · what frequency does nfc use

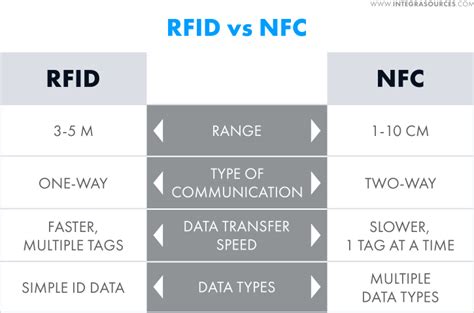

1 · rfid vs nfc difference

2 · rfid tags pros and cons

3 · rfid chip pros and cons

4 · rfid and nfc difference

5 · pros and cons of nfc

6 · nfc disadvantages

7 · 13.56 mhz vs 125khz rfid

$16.88

One of the simplest and most convenient methods to determine if a card is RFID or NFC enabled is by using a smartphone with NFC capabilities. With the widespread adoption of NFC technology in modern smartphones, this . That’s because contactless credit card payments are enabled by a type of RFID technology called near-field communication, or NFC.Many RFID and NFC cards are marked with their respective technology identifiers. For . One of the simplest and most convenient methods to determine if a card is RFID or NFC enabled is by using a smartphone with NFC capabilities. With the widespread adoption of NFC technology in modern smartphones, this method allows you to quickly check if a card contains RFID or NFC technology.

That’s because contactless credit card payments are enabled by a type of RFID technology called near-field communication, or NFC.

Many RFID and NFC cards are marked with their respective technology identifiers. For example, NFC cards may have the “NFC” label or related symbols, while RFID cards might be marked with “RFID.”. If you see these labels, you can typically determine the card’s technology type.To determine whether a card is RFID or NFC, you can start by looking at the card issuer’s description of the card. A contactless credit card, for example, is likely to be either RFID or NFC enabled. If the card allows for card emulation, it is probably an NFC card.

RFID credit cards operate through a process known as near-field communication (NFC). NFC allows for short-range wireless communication between an RFID tag in the credit card and an NFC-enabled reader, typically found in payment terminals. RFID credit cards are considered safe to use, and credit card fraud using RFID readers is rare and difficult to do. Radio-frequency identification (RFID) credit cards have a.The RFID-looking symbol on a debit or credit card is the EMVCo Contactless Indicator *. It indicates that your card can be used to tap to pay on a contactless-enabled payment terminal. Contactless cards use radio-frequency identification (RFID) and near-field communication (NFC) technologies. They enable the card to communicate with the card reader when the card is held near the reader during a transaction.

what frequency does nfc use

RFID-enabled credit cards use NFC, a subset of RFID technology, for short-range communication. Unlike broader RFID uses (such as inventory tracking or passport scanning), NFC operates at distances of only 1-4 cm, ensuring secure, close-range communication between the card and terminal. An RFID credit card is a contactless credit card that interacts with a card reader over a short range using radio-frequency identification (RFID) technology. RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of information One of the simplest and most convenient methods to determine if a card is RFID or NFC enabled is by using a smartphone with NFC capabilities. With the widespread adoption of NFC technology in modern smartphones, this method allows you to quickly check if a card contains RFID or NFC technology.

That’s because contactless credit card payments are enabled by a type of RFID technology called near-field communication, or NFC.Many RFID and NFC cards are marked with their respective technology identifiers. For example, NFC cards may have the “NFC” label or related symbols, while RFID cards might be marked with “RFID.”. If you see these labels, you can typically determine the card’s technology type.To determine whether a card is RFID or NFC, you can start by looking at the card issuer’s description of the card. A contactless credit card, for example, is likely to be either RFID or NFC enabled. If the card allows for card emulation, it is probably an NFC card. RFID credit cards operate through a process known as near-field communication (NFC). NFC allows for short-range wireless communication between an RFID tag in the credit card and an NFC-enabled reader, typically found in payment terminals.

RFID credit cards are considered safe to use, and credit card fraud using RFID readers is rare and difficult to do. Radio-frequency identification (RFID) credit cards have a.

The RFID-looking symbol on a debit or credit card is the EMVCo Contactless Indicator *. It indicates that your card can be used to tap to pay on a contactless-enabled payment terminal.

Contactless cards use radio-frequency identification (RFID) and near-field communication (NFC) technologies. They enable the card to communicate with the card reader when the card is held near the reader during a transaction.RFID-enabled credit cards use NFC, a subset of RFID technology, for short-range communication. Unlike broader RFID uses (such as inventory tracking or passport scanning), NFC operates at distances of only 1-4 cm, ensuring secure, close-range communication between the card and terminal.

mifare card clone

mifare ic cards

rfid vs nfc difference

rfid tags pros and cons

Grove NFC features a highly integrated transceiver module PN532 which handles contactless communication at 13.56MHz. You can read and write a 13.56MHz tag with this module or implement point to point data exchange with two NFCs. .

do credit cards have rfid or nfc|rfid chip pros and cons